The automotive sector is regularly faced with market-wide challenges that can shake the industry to the core. Rarely however, has the industry faced so many challenges as it currently is.

The diesel emissions scandal, Brexit, global trade disputes amongst the world’s largest car manufacturing and sales markets, and the electrification and autonomation of the transport fleet are just some of the key issues that companies engaged in the automotive supply-chain must currently consider.

So how should a company deal with such periods of uncertainty and falling market demand?

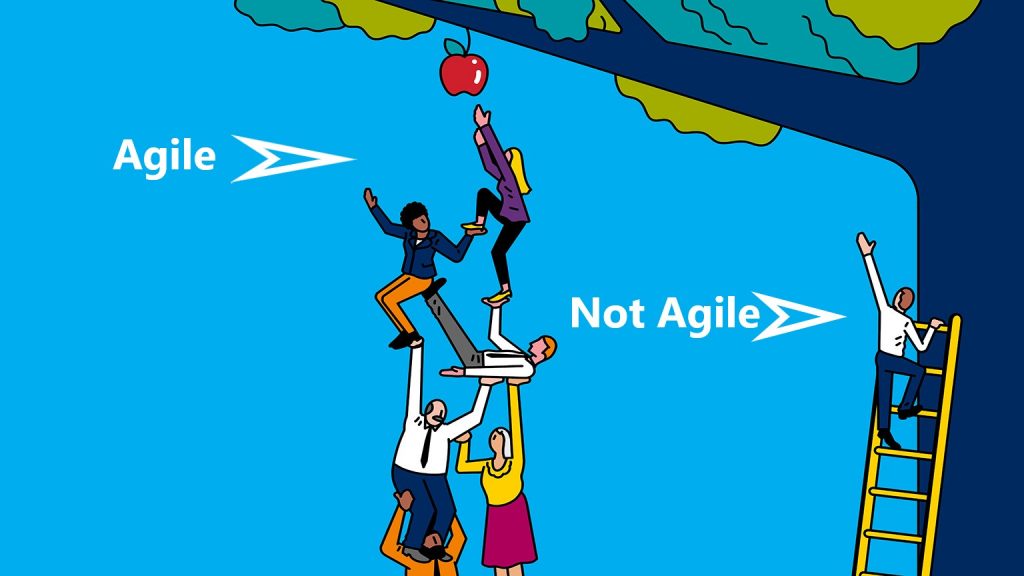

Build your resilience and improve your agility.

Irish Pressings has found that the core ingredients to dealing with market-uncertainty and turbulence is to (i) build resilience within your company to be able to absorb some of the external shocks, and (ii) improve your agility so that you can react to shocks and maximise the opportunities that can arise from a market shake-up.

Irish Pressings has always tried to integrate resilience and agility into the core of its’ operations. We presently see a lot of similarities between the current market turmoil and that which took place in 2008 with the global recession and so any lessons that we learned from at that time are being utilised this time around.

During the 2008-2014 period, many companies operating in the automotive industry suffered greatly as they were neither resilient nor agile enough to react to the economic crash. This can happen for a variety of reasons including becoming “comfortable” with your existing client base or becoming over-reliant on a small number of core customers. Taking this approach leaves a company very exposed to an economic shock.

Consider this example – imagine you are a supplier of exhaust systems to a UK-based car manufacturer. Over the past 5 years you have worked hard with this supplier to gain a significant work package that represents some 70% of your company’s turnover. While such a contract in itself is to be celebrated, efforts must be then taken to mitigate the potential risks of being exposed to this single contract which – as we are currently seeing – can disappear at fairly short notice as a company may seek to wind down its UK-based operations for whatever reason. It is often too late after this has happened to go seeking new business as there will be several companies in the same boat as you, thus making it a very competitive market and an unfortunate downward spiral can commence.

Irish Pressings has developed a business strategy that reduces this risk-exposure and retains its agility by continually pursuing new custom – even when order books are full – as that allows the company to continuously make new contacts, work on new products, gain insights and experience in new sectors – both geographical and industrial – and pushes us to continually make efficiency gains as we seek to maximise our production capabilities. This means that at times of turmoil, Irish Pressings is able to react and reach out to new customers – across regions and sectors – with whom we already have a relationship.

Similarly, resilience has been built into Irish Pressings DNA. It is an essential piece of any SME’s armoury. Every company and sector will face significant challenges from time-to-time. It is how resilient you are to deal with the initial blow that allows you to then showcase your agility and position yourself to maximise new opportunities within the turbulent economic sector.

If as an SME you are concerned about your exposure to large individual contracts or sectors, it is worth checking out the “Pareto Principle”. Broadly speaking the “Pareto Principle” is where 80% of a company’s turnover is coming form 20% of its customer base (UK). While this might work for some companies and sectors, it is worth considering that if those 80% of customers are from the same market sector – e.g. UK automotive sector – and that sector hits a period of turbulence, your company is highly exposed to possible negative impacts. In such a scenario, that company may seek to reduce this 80:20 ratio by diversifying into alternative sectors and reducing exposure to over-reliance on one market i.e. a company may seek to have only 60% of its turnover from 20% of its customer base (UK).

It can be thought of as “hedging your bets”. For more info on the Pareto Principle check out Kevin Kruse’s Forbes article entitled “The 80/20 Rule And How It Can Change Your Life”.